The company plans to parallel Tesla's model of selling luxury cars initially, then transitioning into more affordable markets. What does Lucid expect to deliver in 2026? Two hundred fifty-one thousand vehicles, total - 134,000 of which will be SUVs. The SUV model is called Gravity and is expected to make up more than 60% of total deliveries by 2026. In five years, it expects 36,000 Lucid Air deliveries and 12,000 SUV deliveries. By then, it wants 20,000 vehicles on the road and over $2 billion in revenue. Lucid expects to have cars on the road by 2022. And that lends further confidence to the company's projections for itself down the line. That's certainly more transparency than we got with Nikola. However, Lucid did instill more confidence after announcing a production preview event where it will test-drive cars at its Casa Grande, Arizona facility. Now that we're in September, the Q4 2021 projection is starting to look questionable.

The biggest reason early investors have piled out of Lucid was likely the apparent lag in its hallmark product release, the Lucid Air Dream Edition. If the company can only manage to pass a couple specific milestones, it will prop up the long-term "buy" case for Lucid stock.Īnd here it is. Shares rallied back to $18, however, and Lucid appears to have plenty more in the tank. Unfortunately, they only took home a couple bucks per share, fractions of what they would have made many months before. Here, we see a case of the early CCIV investors taking profits on the $15 shares they bought earlier. Unfortunately, this sometimes becomes a matter of putting pain off for later. You see, IPOs and SPAC mergers usually involve a "lockup" period to prevent early-stage PIPE investors from piling their shares into the market and quickly diluting the price. 31, shares dropped 15%, from $19 to $16 in a single day. New shares were just released from lockup.

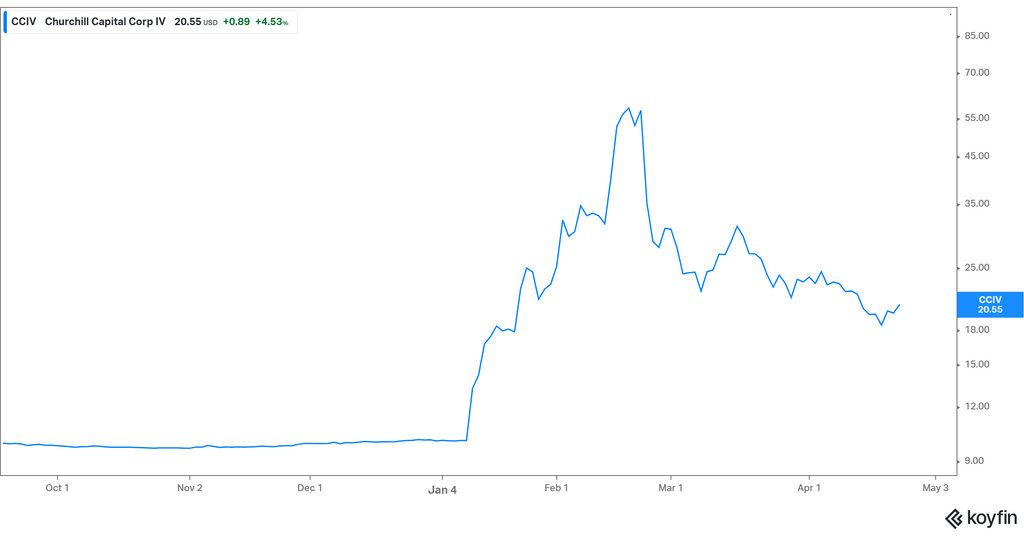

It quickly tanked and leveled off in the $20 range, but months later, we're starting to see new bearish momentum. So, we see the technology impresses the industry, and production looks tenable.ĭo these factors make Lucid a "Tesla Killer" though? Lucid Stock Performance After the SPAC MergerĬCIV stock popped 540% when rumors of the merger hit, going from $10 to $64. MotorTrend recently highlighted Lucid for greater battery efficiency than the Tesla Model S as well as a cost-effective powertrain developed in-house. More importantly, the experts have good things to say about it. The difference between Lucid and the EV flops in the past is that it has a product, at least. (NYSE: CCIV), one of the most talked-about to date, billed as the largest SPAC deal ever for an electric vehicle stock, at $12 billion.Įarly in 2021, management provided its own five-year CCIV stock prediction. This company is the product of a SPAC merger with Churchill Capital Corp. Many of them might even refer to themselves as "Tesla Killers" with nothing to back it up.īut Lucid Group Inc. Most EV companies post bold numbers to increase investor and consumer interest.

Save my name, email, and website in this browser for the next time I comment. Sign me up for the Money Morning newsletter Your email address will not be published. Or to contact Money Morning Customer Service, click here. Comment on This Story Click here to cancel reply.

0 kommentar(er)

0 kommentar(er)